Payment Card Industry Data Security Standard (PCI DSS)

Privasec is now a Sekuro Company

What is PCI DSS?

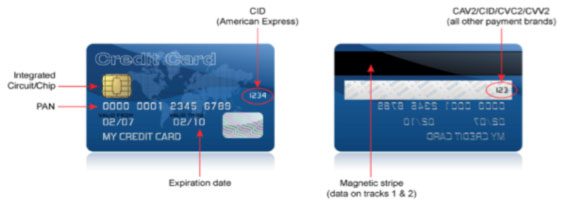

Payment Card Industry Data Security Standards (PCI DSS) is a the global security standard that businesses of any size must adhere to to accept payment by card and either store/ process and/or transmit cardholder data. Set out by the Payment Card Industry Security Standards Council (PCI SSC), the PCI DSS requirements are founded and enforced by Payment Brand (through your acquiring bank/s).

Designed to be both practical and comprehensive, PCI DSS encompasses rigourous controls aligned to security best practices. It focuses on safeguarding cardholder’s data (CD) centred around Primary Account Number (PAN), which is the key identitfier for payment card transactions.

Who Has to Comply With the PCI DSS?

The PCI DSS applies to all entities that store, process, and/ or transmit cardholder data, which includes both merchants and service providers.

- Merchants are required to comply with the PCI DSS to safeguard cardholder data. Compliance levels may vary based on transaction volume.

- Service providers must comply with the PCI DSS to ensure the secure handling of cardholder data. They may undergo regular assessments to validate their compliance

- Payment processors are subject to PCI DSS compliance to ensure the secure handling of payment data during the processing and transmission phases.

It is about making PCI compliance part of your business, not a once-a-year, study-for the test thing

Bob Russo, General Manager of the PCI SSC

How to Comply?

PCI DSS covers technical and operational system components included in, or connected to, the cardholder data handled. The reporting requirements differ based on the business (service providers or merchants), the number of cards processed annually, and how payments are taken (in-person, phone, mail, fax or e-commerce).

Here are some guidelines to achieve PCI DSS compliance:

- Determine your compliance level, as this will influence the specific requirements and assessments applicable to your organisation.

- Ensure the security of your network infrastructure by segmenting cardholder data from other systems, restricting access to cardholder data based on business need-to-know, and implementing secure Wi-Fi protocols.

- Implement strong access controls by assigning unique IDs to each person with computer access, restricting physical access to cardholder data, and regularly monitoring and testing access controls.

- Conduct regular monitoring and testing of networks, including the use of intrusion detection systems, performing penetration testing, and regularly testing security systems and processes.

- Train employees on security best practices and the organisation’s information security policies. Ensure that employees are aware of their roles and responsibilities in maintaining PCI DSS compliance.

12 Core Requirements of PCI DSS

PCI DSS outlines 12 core requirements designed to enhance the security of cardholder data. These requirements form the foundation for organisations seeking compliance with PCI DSS.

- Safeguard cardholder data by installing and consistently maintaining a secure firewall configuration.

- Enhance system security by refraining from using default vendor-supplied settings for passwords and other security parameters.

- Protect stored cardholder data through robust security measures.

- Ensure the secure transmission of cardholder data by encrypting it when transmitted over open, public networks.

- Bolster defences against malicious software by employing and consistently updating anti-virus software or programmes.

- Foster a secure environment by continuously developing and maintaining systems and applications with strong security features.

- Boost data security by limiting access to cardholder data and granting permissions based on business necessity.

- Strengthen access controls by assigning a unique identifier to each individual with computer access.

- Safeguard cardholder data by restricting physical access to authorised personnel only.

- Ensure accountability and security by monitoring and tracking all access to network resources and cardholder data.

- Validate and improve security measures through routine testing of systems and processes.

- Encourage a security-aware culture by maintaining and communicating policies that address information security for all personnel.

Our PCI DSS Services

Privasec offers peace-of-mind PCI DSS-as-a-Service to help organisations stay compliant throughout the years, to every version of the PCI DSS.

Commited to build a strong and long lasting relationship with our customers, our dedication involves collaborating with our clients to adopt a practical strategy tackling the challenges and concerns faced by the business in relation to the compliance program. We strive to effectively reduce your compliance issues.

PCI DSS Scope and Gap Assessment

Find compliant options to reduce your scope and create a plan to fix your non-compliances.

PCI DSS Remediation

Expert guidance and advice to remediate your non-compliances and keep your costs down.

PCI DSS Penetration Testing and Wireless Scanning

Ad-hoc or managed Penetration Tests and Wireless Scans as required by the PCI DSS.

PCI DSS Certification

Qualified assessment of your compliance status and deliverance of your Attestation of Compliance (AOC).

PCI DSS Maintenance

Maintain your compliance throughout the year and avoid the stress of recertification.

PCI-DSS-as-a-Service

Piece-of-mind all-inclusive service to ensure you reach and maintain compliance whilst getting best value for your business.

About Privasec, A Sekuro company

We provide tailored and collaborative solutions to meet your business goals as well as your compliance requirements

We assign Qualified Services Assessors (QSAs) who are the right culture fit for your organisation and project

We don’t just tick boxes – our professionalism, values and our work set us apart. Our QSAs have gained industry knowledge and efficiency through years of experience

Not sure if this applies to you?

Don’t leave it to the last minute. Contact us and find out.